There's a lot of misinformation out there about the VA loan. Here's some thing you may not know:

At The Homefront Team, we bring the same dedication and operational expertise gained through military service to serving our military and law enforcement clients. Our commitment to supporting those who serve has shaped our innovative approach, redefining the real estate process and challenging traditional norms. This mission-driven focus has positioned us as leaders in helping veterans and first responders achieve their real estate goals. We’re proud to provide exceptional service and ensure a seamless experience for our clients. Outside of work, we value time with family, friends, and our beloved canine companions.

Reach Out To Me

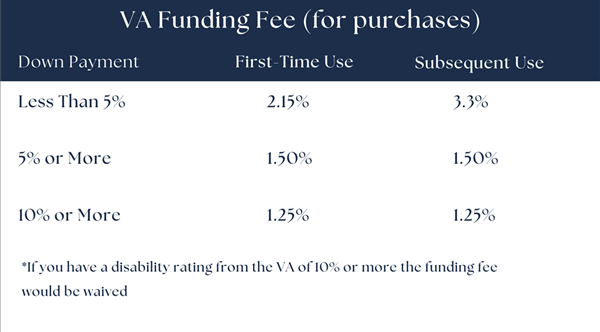

A VA loan advantage is the option for a zero-down payment. However, a funding fee is required, which many buyers incorporate into their mortgage. This fee is exempted for those with a VA disability rating of 10% or higher.

If you possess a VA disability rating of any percentage, the funding fee is waived for you. Not holding a rating yet? Let's discuss. I can introduce you to a specialist who can guide you in initiating your claim. I'd advise you to fill out the documentation via this link before finalizing a home purchase. This way, should your claim gain approval, we can ensure you receive a refund. To delve deeper into this, give me a ring at 612-408-1953.

VA Intent to File

Veterans who are totally and permanently disabled (100% T&P) are eligible for a valuation exclusion of $300,000 on their property tax value. Veterans who are not totally and permanently disabled, but who have a disability rating of 70 percent or higher, are eligible for an exclusion of $150,000. If a qualifying veteran does not own a house, but has a designated “primary family caregiver” who does own a house, the caregiver can receive the exclusion for the time he or she continues in that role.

Homestead Valuation Exclusion Form

We are honored by the complete satisfaction our clients express regarding our services as their trusted real estate team. Take a moment to explore their testimonials and hear about their experiences working with us. Their trust has always been our top priority, and we promise to deliver the same exceptional service and dedication to you.

Google ReviewsFor sale: Properties which are available for showings and purchase

Active contingent: Properties which are available for showing but are under contract with another buyer

Pending: Properties which are under contract with a buyer and are no longer available for showings

Sold: Properties on which the sale has closed.

Coming soon: Properties which will be on the market soon and are not available for showings.

Contingent and Pending statuses may not be available for all listings