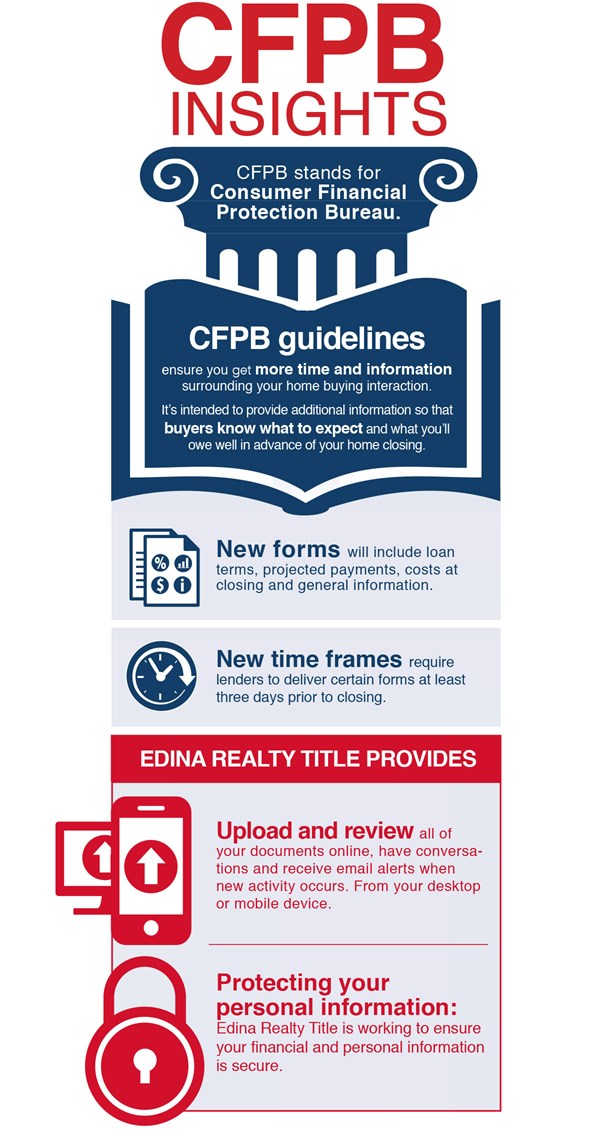

Owning a home is a significant component of the “American Dream,” and millions of real estate agents, and lending and title professionals work together every day to help buyers achieve that dream. In the last few years, the industry and our nation’s leaders have worked to offer additional transparency and efficiency for homebuyers. As part of the Dodd-Frank Act, the Consumer Finance Protection Bureau (CFPB) was created to integrate and improve existing lending and closing forms so homebuyers were fully informed and given enough time to make responsible decisions.

Below, we outline the changes and benefits for buyers that will apply to loan applications taken on or after Oct. 3, 2015.

New timelines and forms

Within three days of applying for a loan, homebuyers will receive a Loan Estimate. The new loan estimate will help buyers understand key features of the mortgage including interest rates, monthly payments and whether or not there is a penalty for early pay off. The three-day requirement gives buyers additional time to review the loan terms and ask questions

At least three days prior to closing, the homebuyers will also receive a new document called the Closing Disclosure Form (CDF). The CDF provides buyers with a preview of their closing costs so they are informed at an earlier stage in the process.

At closing, as usual, all parties will receive a Settlement Statement, which presents all charges and credits to the buyer and to the seller.

Benefits of the new process

The new forms offer clear language and design, and highlight the information that matters most to buyers. Buyers can also see information about the costs of taxes and insurance, and how their interest rate and payments could change in the future. Last, the new guidelines give homebuyers more time to review their lending information and make the best decisions for their needs.

What happens if I’ve already applied for a loan?

The new CFPB guidelines go into effect for loan applications taken on or after Oct. 3, 2015. Since you’ve already applied, your loan won’t require the new timelines and forms, but you can always work with your real estate agent and mortgage loan officer to fully understand the financials of your home purchase, including your interest rate, total loan amount, closing costs and more.

Still have questions?

Our local mortgage specialists are always here to walk you through the mortgage process and to make your closing a success. If you have questions, contact Edina Realty customer care seven days a week. The lending professionals at Edina Realty Mortgage can get you started on the process of applying for a mortgage.

Don’t forget to look at #BuyerInsights on Twitter, Facebook, Instagram and YouTube for more insights you can use to navigate the home buying process.

Edina Realty Mortgage is an affiliate of Edina Realty. See Affiliated Business Arrangement Disclosure Statement.

Equal Housing Lender | Prosperity Home Mortgage, LLC may operate as Prosperity Home Mortgage, LLC dba Edina Realty Mortgage in Minnesota and Wisconsin. ©2024 Prosperity Home Mortgage, LLC dba Edina Realty Mortgage. (877) 275-1762. 3060 Williams Drive, Suite 600, Fairfax, VA 22031. All first mortgage products are provided by Prosperity Home Mortgage, LLC. Not all mortgage products may be available in all areas. Not all borrowers will qualify. NMLS ID #75164 (For licensing information go to: NMLS Consumer Access at http://www.nmlsconsumeraccess.org/) Licensed by the Department of Financial Protection and Innovation under the California Residential Mortgage Lending Act. Licensed by the Delaware State Bank Commissioner. Georgia Residential Mortgage Licensee. Massachusetts Mortgage Lender and Mortgage Broker MC75164. Licensed by the NJ Department of Banking and Insurance. Licensed Mortgage Banker-NYS Department of Financial Services. Rhode Island Licensed Lender. Rhode Island Licensed Loan Broker. Rhode Island Licensed Third-Party Loan Servicer. Also licensed in AK, AL, AR, AZ, CO, CT, DC, FL, ID, IL, IN, KS, KY, LA, MD, ME, MI, MN, MO, MS, MT, NC, ND, NE, NH, NM, NV, OH, OK, OR, PA, SC, SD, TN, TX, UT, VA, VT, WA, WI, WV and WY.

Equal Housing Lender | Prosperity Home Mortgage, LLC may operate as Prosperity Home Mortgage, LLC dba Edina Realty Mortgage in Minnesota and Wisconsin. ©2024 Prosperity Home Mortgage, LLC dba Edina Realty Mortgage. (877) 275-1762. 3060 Williams Drive, Suite 600, Fairfax, VA 22031. All first mortgage products are provided by Prosperity Home Mortgage, LLC. Not all mortgage products may be available in all areas. Not all borrowers will qualify. NMLS ID #75164 (For licensing information go to: NMLS Consumer Access at http://www.nmlsconsumeraccess.org/) Licensed by the Department of Financial Protection and Innovation under the California Residential Mortgage Lending Act. Licensed by the Delaware State Bank Commissioner. Georgia Residential Mortgage Licensee. Massachusetts Mortgage Lender and Mortgage Broker MC75164. Licensed by the NJ Department of Banking and Insurance. Licensed Mortgage Banker-NYS Department of Financial Services. Rhode Island Licensed Lender. Rhode Island Licensed Loan Broker. Rhode Island Licensed Third-Party Loan Servicer. Also licensed in AK, AL, AR, AZ, CO, CT, DC, FL, ID, IL, IN, KS, KY, LA, MD, ME, MI, MN, MO, MS, MT, NC, ND, NE, NH, NM, NV, OH, OK, OR, PA, SC, SD, TN, TX, UT, VA, VT, WA, WI, WV and WY.